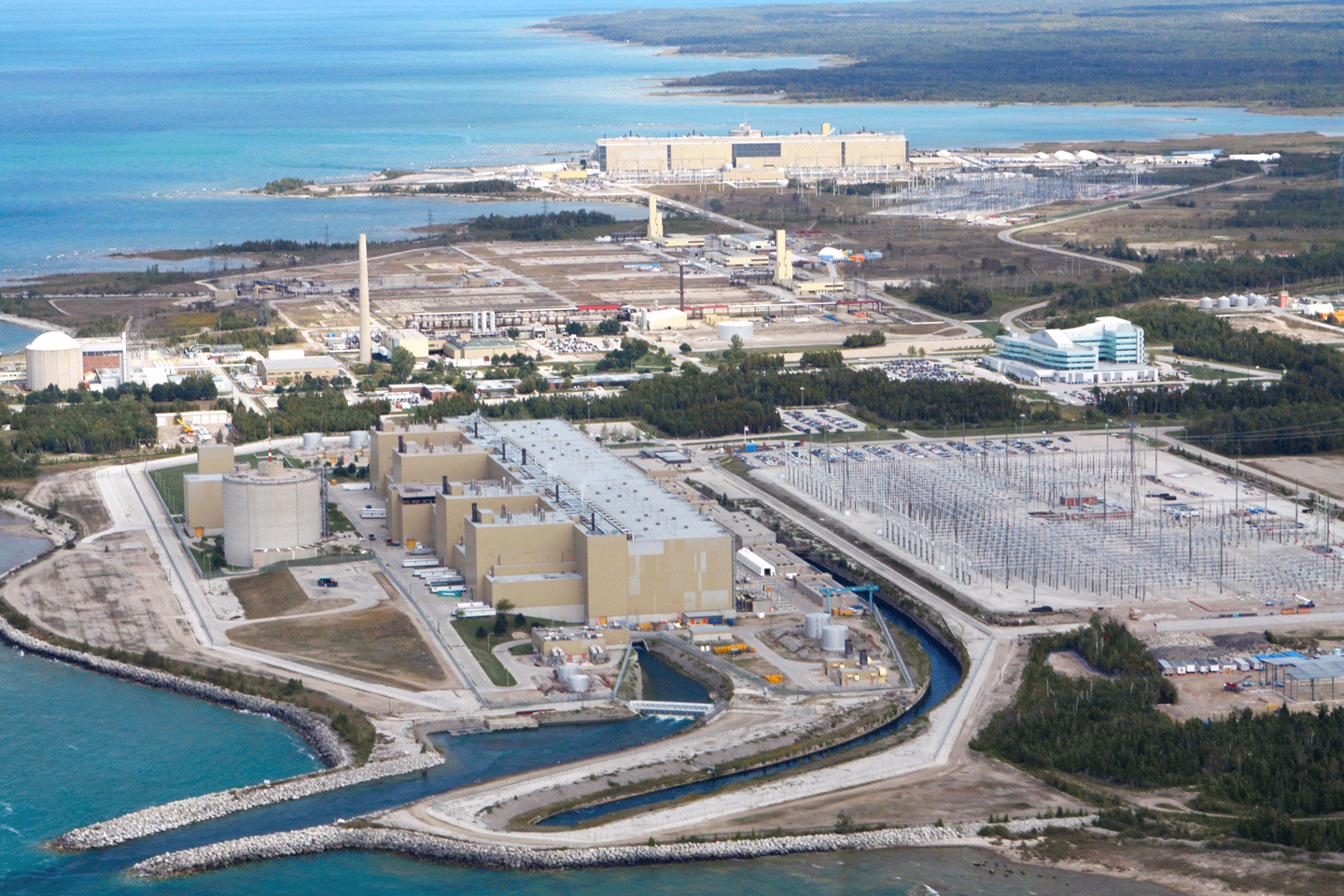

The Bruce nuclear power plant. (Photo: Bruce Power)

Canada’s Bruce Power, operator of Ontario’s eight-unit Bruce nuclear power plant, has announced the issuance of C$600 million (about $446.3 million) in green bonds in support of the company’s net-zero-by-2027 goal. (Investopedia defines green bonds as fixed-income instruments specifically earmarked to raise money for environmentally friendly projects.)

Outokumpu’s steel mill in Tornio, Finland. (Photo: Outokumpu)

Fortum—operator of Finland’s two-unit Loviisa nuclear power plant—has signed a memorandum of understanding with Finnish stainless steel producer Outokumpu to explore decarbonizing the latter’s manufacturing operations with the help of emerging nuclear technologies, the companies announced on March 23.

These graphs illustrate how rapidly scaling the nuclear industrial base would enable nearer-term decarbonization and increase capital efficiency, versus a five-year delay to reach the same 200 GW deployment by 2050. (Source: DOE, Pathways to Commercial Liftoff: Advanced Nuclear, Fig. 1)

The Department of Energy released Pathways to Commercial Liftoff: Advanced Nuclear earlier this month. It is one of the first in a series of reports on clean energy technologies and the private and public investments needed to overcome hurdles to full-scale deployment. The report makes a clear case for investment in nuclear power and challenges potential investors and operators to move beyond the current “wait and see” stalemate and generate “a committed orderbook . . . for 5–10 deployments of at least one reactor design by 2025.”

Dignitaries assemble after the signing of a memorandum of agreement to help Indonesia develop a nuclear energy program. Among those at the signing were Indonesia's minister for economic affairs Airlangga Hartarto, U.S. ambassador to Indonesia Sung Y. Kim, and U.S. Department of State principal deputy assistant secretary Ann Ganzer. (Photo: State Dept./Erik A. Kurniawan)

The United States and Indonesia have announced a strategic partnership to help the latter nation develop its nuclear energy program, supporting its interest in deploying small modular reactors to meet energy security and climate goals.

Philippine president Ferdinand R. Marcos Jr. and Vice President Harris meet in Manila on November 21. (Photo: Office of the Press Secretary, Republic of the Philippines)

During a recent weeklong trip to Southeast Asia aimed at bolstering U.S. economic and security ties in the region, Vice President Kamala Harris announced the launch of nuclear energy partnerships with Thailand and the Philippines.

Currently, neither country enjoys the benefits of nuclear power. Both rely primarily on some mix of petroleum, natural gas, and coal for their energy needs.

The Bruce Power A and B nuclear power plants. (Photo: CNSC)

Canada’s Bruce Power, operator of the eight-unit Bruce nuclear plant in Kincardine, Ontario, has announced a “made-in-Ontario solution” to the net-zero challenges faced by industries: allowing new incremental nuclear output to be accredited for an avoided emissions benefit.

The Naughton coal-fired power plant near Kemmerer, Wyo., has two units set to retire in 2025 and be replaced by a TerraPower Natrium reactor. (Photo: PacifiCorp)

Nuclear power generation surpassed coal generation in the United States for the first time in 2020. As utilities continue to retire coal-fired plants, reusing the shuttered sites to host nuclear reactors could help the nation reach the goal of net-zero emissions by 2050 and prove economically beneficial both for nuclear deployments and for the communities impacted by fossil fuel generation. That’s according to a Department of Energy report released this week, detailing how hundreds of U.S. coal power plant sites that have recently retired or plan to close within the decade could be suitable for new nuclear power plants. Nuclear power’s high capacity factors mean those plants could deliver an added benefit—delivering more baseload power to the grid from the nameplate capacity replacement.